Today, the Council of Ministers adopted the revised Draft Budget Bill for 2022 (“PLFR”).

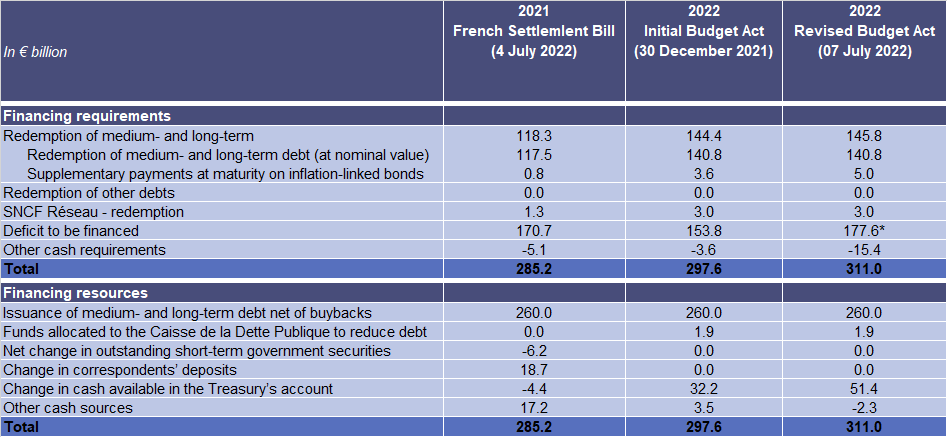

The State's borrowing requirement for 2022 is revised to €311.0 billion, which represents an increase of €13.4 billion compared to the initial budget Act (“LFI”). This increase in the financing requirement is mainly due to the increase in the general budget expenditure, in particular to support the purchasing power in an inflationary context, and to the replenishment of the "State Financial Holdings" special appropriation account (“CAS PFE”) to finance operations that may occur in the second half of the year. This increase is partially offset by a rise in forecasted State revenue

The increase from €153.8 billion to €177.6 billion of the “deficit to be financed” line is also due to the increase of the indexation charge provision on inflation-linked bonds. As the additional indexation supplement is paid at maturity, this provision is however offset by the "other cash requirements" line (see table below). The only additional indexation supplement (€1.4 billion) impacting 2022 financing requirements relates to inflation-linked bond amortised in 2022.

The increase in the State’s borrowing requirement will be financed by an increase in the contribution of the Treasury account to the financing resources, which will amount to € 51.4 billion, compared to €32.2 billion forecasted in the LFI.

This contribution will cover both the increase in the borrowing requirement and the downward revision of other cash resources (€-2.3bn compared with €+3.5bn in the LFI), which come from the discounts recorded on new issues in the context of rising interest rates. The cash available on the Treasury account makes this contribution possible, in particular through a reduced deficit in 2021 of €170.7 billion, compared to the €205.1 billion initially forecasted in the second Revised Budget Bill for 2021 of 1 December 2021.

The medium- and long-term debt issuance programme and the variation in short-term debt outstanding (BTFs) remain unchanged compared to the LFI (€260.0 bn of medium- and long-term issuance net of buybacks and no change in BTFs outstanding at year-end).

*The difference of €9.1 billion between the deficit to be financed at €177.6 billion shown in this table and the budget balance as shown in the balance table of the draft amending budget bill, at €168.3 billion, is explained by carryovers from 2021 to 2022.

Information:

+33 1 40 04 15 50 – contact@aft.gouv.fr