This page is an archive, only available in English and French.

2016

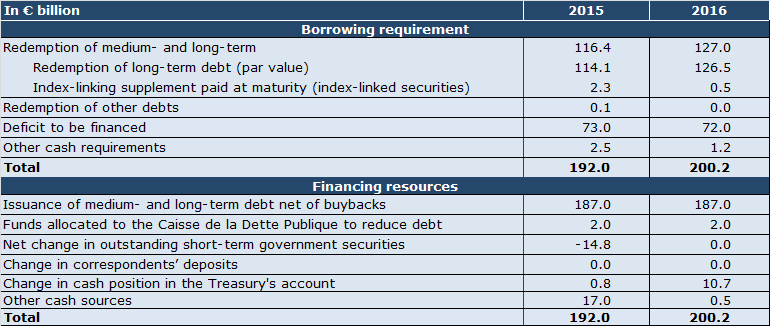

1. The 2016 French budget bill was adopted this morning by the Government. The total financing requirement for the State will amount to €200.2 billion, out of which €72 billion result from the deficit to be financed and €127 billion from the redemption of the medium- and long-term debt due in 2016.

2. Financing requirement in 2016 will be financed by (i) the medium- and long-term debt issuance programme which is set at €187 billion (ii) €2 billion resources thanks to the active management of State stakeholdings, earmarked for debt reduction and (iii) a €10.7 billion contribution coming from the Treasury account.

3. The other financing resources are stable or almost stable.

4. The State debt service is projected at €44.5 billion.

5. The details of the funding programme for 2016 will be released in December 2015.

2015

6. Since the beginning of 2015, France has continued to benefit from very favorable financing conditions. The weighted average rate on medium- and long-term securities stands at 0.62% over the first three quarters of the year, compared to a historical low of 1.31% in 2014, and an average of 4.15% over the period 1998-2007.

7. The deficit to be financed in 2015 is revised downward to € 73 billion, compared to €74.4 billion expected in the 2015 Initial Budget Act passed in December 2014.

8. BTF outstanding at the year-end 2015 will be reduced by €14.8bn compared to a stabilization planned in the Initial Budget Act. This downward revision in the BTF outstanding is mainly due to the increase in net issuance premiums. Indeed, cash resources are revised upwards, at €17 billion, compared to € 0.5 billion in the Initial Budget Act, due mainly to the additional issuance premiums recorded on medium- and long-term debt since the beginning of the year. The size of the amount of premiums is due to the level of yields of tapped bonds which, since the beginning of the year, have almost always been lower than the coupon yields.

9. For 2015, medium- and long-term debt issuances net of buybacks amount to € 187 billion. By the end of September, the State had issued €178.2 billion of medium- and long- term debt, i.e. 95.3% of the 2015 programme.

10. The State debt interest charge is projected at €42.4 billion compared to €44.3 billion expected in the 2015 Initial Budget Act.

Press contact:

+33 1 4004 1550

+33 6 7224 0388