This page is an archive, only available in English and French.

Agence France Trésor today announces the launch of the OAT€i 0.70% 25 July 2030. After the opening of the order book on Tuesday morning and its completion at midday, demand reached an amount close to € 6 bn, of which € 3.5 bn was allocated.

The yield at the time of the launch is 0.76%. The price has been set at 99.094. The settlement date is June, 18 2014. The bond will be strippable and it will be quoted on Euronext Paris.

Lead managers for this operation were BNP Paribas, Crédit Agricole CIB, HSBC, Nomura and Société Générale. All the primary dealers were part of the syndicate.

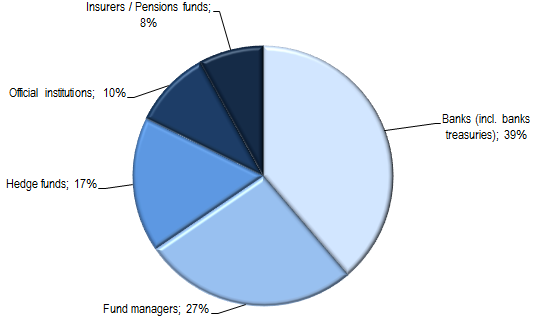

The allocation illustrates a strong and diversified demand from final investors. The allocation shows a large proportion of fund managers (27%), banks (39%), hedge funds (17%), insurance & pensions funds (8%), and official institutions (10%).

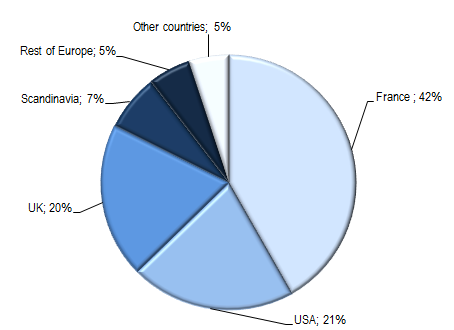

The geographical distribution reflects a strong demand from European investors, with France representing 42%, United Kingdom 20%, Scandinavia 7%, other European countries 5%, USA 21%, and other countries 5%.

Press contact:

Tân Le Quang

+33 1 40 04 15 50

+33 6 72 24 03 88