Agence France Trésor announces today the launch of the new OAT 0.50% 25 May 2040. After the opening of the order book on Wednesday early morning and its completion at midday, total demand reached a record level of almost €51bn, of which €7bn were allocated.

The price has been set at 99.527, reflecting a yield of 0.525% at issuance, establishing a new record low in terms of yield at issuance for an AFT syndication of a long end 20-year area OAT.

Lead managers for this operation were Barclays, BNP Paribas, Deutsche Bank, NatWest Markets and Société Générale. All the primary dealers were part of the syndicate.

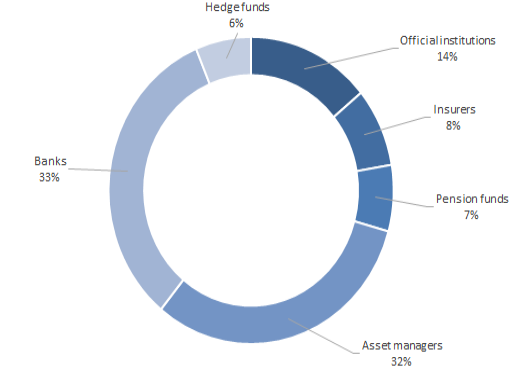

The allocation illustrates the diversity and the quality of the investor base on which relies the French sovereign debt market. Almost 400 final investors took part in the transaction - also a record level. The syndicated amount has been allocated to official institutions for 14%, insurers for 8%, pension funds for 7%, asset managers for 32%, banks for 33% and hedge funds for 6%.

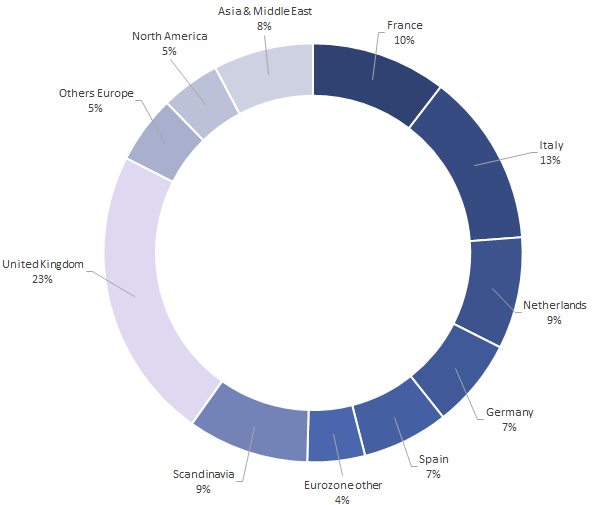

The geographical distribution reflects a strong demand from European and International investors for French government bonds with long maturities, with Eurozone representing 50% - France 10%, Italy 13%, Netherlands 9%, Germany 7%, Spain 7% - other Eurozone 4%, Scandinavia 9%, the United Kingdom 23%, Asia and Middle East 8% and North America 5%.

Further details

The settlement date for the OAT is 3 June 2020. The bond will be strippable and quoted on Euronext Paris. It will be tapped depending on market demand to guarantee sufficient market liquidity.

Contact:

+33 1 40 04 15 50