This page is an archive, only available in English and French.

Bruno Le Maire, Minister for the Economy and Finance, has approved the indicative State financing programme for 2018.

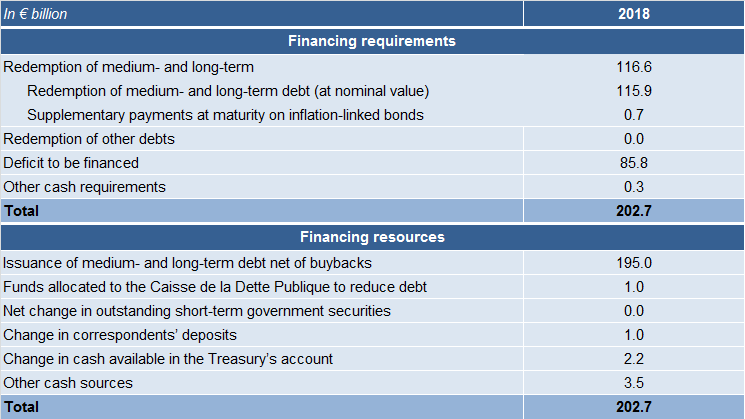

In 2018, the State will need to finance a fiscal deficit forecast at €85.8bn1 and redeem €116.6bn in medium- and long-term debt maturing during the year (after buybacks in 2016 and 2017 of €25.3bn in securities maturing in 2018), as well as finance other cash requirements totalling €0.3bn. Therefore, the government borrowing requirement for 2018 stands at €202.7bn.

This funding requirement will be covered by medium- and long-term borrowing (OATs) of €195.0bn net of buybacks and €7.7bn from other financing sources. Short-term debt outstanding (BTFs) will remain stable.

This financing programme is part of the 2018 French Budget Act, which caps the net year-on-year increase in medium- and long-term negotiable debt at €79.1bn.

As in previous years, Agence France Trésor will adjust its debt issuance programme to meet demand and guarantee a liquid market for its securities. The programme stipulates that issued bonds linked to French or euro area inflation will account for approximately 10% of net medium- and long-term debt issues.

AFT may buy back debt in 2018 (BTFs and nominal and index-linked OATs) depending on market conditions.

FURTHER DETAILS

1. Benchmark issues

AFT will issue one new benchmark maturing in February 2021, one new 5-year benchmark, one new 10-year benchmark and one new 15-year benchmark.

After launching a new 10-year bond linked to French inflation (OATi) in 2017, AFT will aim for a syndicated issue of a new security linked to euro area inflation (OAT€i) in 2018 with a maturity of 15 to 20 years, subject to market conditions. If demand is strong, AFT will also consider auctioning a new 10-year benchmark linked to euro area inflation. Securities linked to French inflation (OATis) will continue to be tapped to meet market demand.

AFT will also continue to tap the green bond first issued in January 2017 to meet market demand, up to the limit of eligible green expenditures for 2018.

2. Auction rules and schedule

An auction of nominal or inflation-linked OATs may take place on the first Thursday of the month in August and December, depending on market conditions and after consultation with primary dealers. During the other months of the year, OATs with maturities of 8 years or more will be auctioned on the first Thursday of each month and OATs maturing in 2 to 8 years (with no possible extensions) will be auctioned on the third Thursday of each month. Auctions of nominal bonds will be held at 10.50am (Paris time), and auctions of inflation-linked bonds at 11.50am (Paris time). BTFs will be auctioned every Monday at 2.50pm (Paris time). AFT will inform the market of any changes to the auction schedule.

Regarding the securities to be auctioned, as in previous years, AFT reserves the right to adapt its issuances by adjusting the composition of benchmark bonds and off-the-run bonds in response to demand from investors as estimated by the primary dealers. Based on advice from primary dealers, it may also decide to tap non-benchmark BTFs.

3. Managing average debt maturity

The strategy to reduce the average maturity of negotiable government debt initiated in 2001 has been put on hold. The interest rate swap programme will resume if and when market conditions allow.

4. 2017 status report

The gross nominal value of medium- and long-term debt issuance in 2017 stood at €213.1bn, consisting of €193.1bn in fixed-rate bonds (OATs) and €20bn in inflation-linked bonds (OATis, and OAT€is).

AFT bought back €18.2bn in debt maturing in 2018 and €9.9bn maturing in 2019.

Contact:

+33 1.40.04.15.50

1Revised on 13 December 2017. This revision does not prejudge to the deficit adopted by the Parliament.