This page is an archive, only available in English and French.

Agence France Trésor today announces the launch of the OAT€I 1.85% 25 July 2027. After the opening on Wednesday morning of the order book and completion at midday, demand reached €4.8bn, of which €3bn was allocated. The real yield as of the launch is 1.898%, 21 basis points over the OAT€i 25 July 2022. The price has been set at 99.323. The settlement date is February 16, 2011.

Lead managers of this operation were Barclays Capital, BNP Paribas, Crédit Agricole, HSBC and Royal Bank of Scotland. All the primary dealers were part of the syndicate.

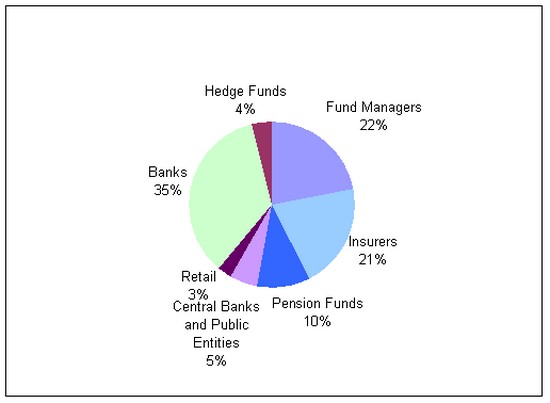

The Book reflects a strong and diversified demand from final investors with a large 100-order book. A large proportion of the Book is allocated to asset managers (22%), to insurance companies (21% ) and to pension funds (10%). The presence of central banks and supranationals (5%) is also noticeable.

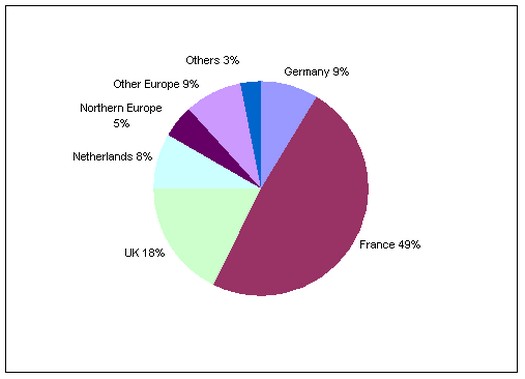

The geographical distribution reflects the strong demand for Euro area inflation-linked-bonds from both French and non-resident investors. The allocation illustrates the interest of French investors 49%, British 18%, Germans 9% and Dutch ones 8%.

This new index linked bond will be regularly auctioned, according to investors demand and in order to guarantee its liquidity.

Press contact:

Pierre Salaun

+33 1 4004 1550

+33 6 7224 0388