This page is an archive, only available in English and French.

Agence France Trésor today announces the launch of the OAT 4.00% 25 April 2060.

After the completion on Tuesday evening of the order book open on Wednesday morning and closed in the early afternoon, total demand reached €8.3bn, of which €5bn was allocated.

The yield at the time of the launch is 4.175%, 2 basis points over the yield of the OAT 4.0% 25 April 2055. The price has been set at 96.34. The settlement date is 17 march 2010, the bond is strippable and it will be quoted on Euronext Paris.

Lead managers for this operation were Barclays, BNP Paribas, Deutsche Bank, JP Morgan and Société Générale. All the primary dealers were part of the syndicate.

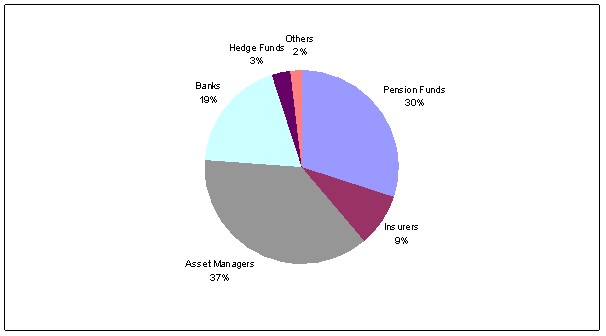

The allocation illustrates the strong investors demand for French long-bonds, from asset managers (37%), pension funds (30%) and from insurers (9%), and their interest for a long term stable credit.

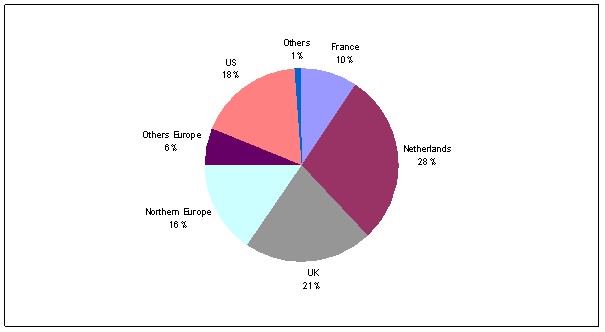

The geographical distribution reflects a strong demand from non-residents for French bonds with very long maturities. If the allocation illustrates the interest of European investors, France representing 10%, the United Kingdom and Netherlands 21% and 28% respectively, and Northern Europe 16%, US investors are also present with 18% of the amount allocated.

Contact Press:

Pierre Salaun

33 1 40 04 15 50

33 6 72 24 03 88