This page is an archive, only available in English and French.

LAUNCH OF THE NEW OAT€i 0.1% 25 July 2047

Agence France Trésor announces today the launch of the new OAT€i 0.1% 25 July 2047. After the opening of the order book on Wednesday 28 September morning and its closure at midday, total demand reached €8.4bn. €4bn were eventually allocated.

The price has been set at 111.628%, equivalent to a real yield of -0.262% at issuance.

Lead managers for this operation were BNP Paribas, Crédit Agricole-CIB, JP Morgan, Natixis and Royal Bank of Scotland. All the primary dealers were part of the syndicate.

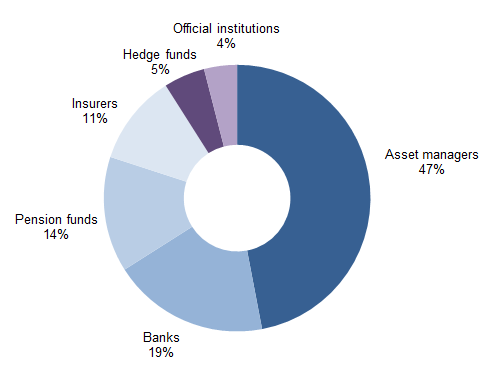

The allocation illustrates a large order book arising from a very diversified investor base. More than 110 final investors took part in the transaction, out of which 47% were asset managers, 14% pension funds, 11% insurance companies, 19% banks, 4% official institutions and 5% hedge funds.

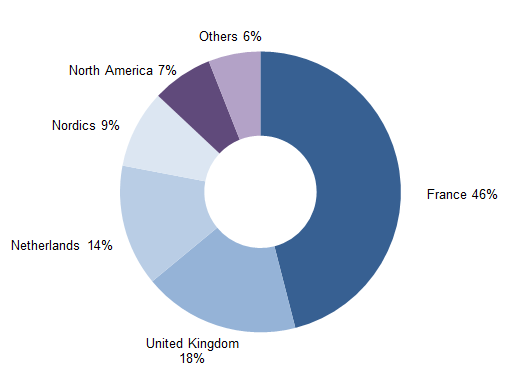

The geographical distribution reflects a strong demand stemming from domestic and international investors for French government bonds linked to euro area inflation with long maturities. France represents 46% of the final allocation, United Kingdom 18%, Netherlands 14%, Nordics 9% and North America 7%.

Further details

The OAT€i will be settled on 5 October 2016 and quoted on Euronext Paris. It will be tapped depending on market demand, in order to ensure its liquidity.

Information:

+33 1 40 04 15 50

+33 6 72 24 03 88