Today, as indicated in its 2025 State financing programme, Agence France Trésor syndicated a tap of OAT€i 0.95% 25 July 2043. After the opening of the order book on Tuesday morning and its completion before midday, total demand exceeded €45 bn, of which €3bn were allocated. The price has been set at 88.63, reflecting a real yield of 1.676% at issuance.

This operation, in addition to the initial €4bn syndicated in May 2024 and the €635 millions issued by auction last February, brings the outstanding amount of this OAT€i to €7.6 billion.

Lead managers for this operation were BNP Paribas, Citi, Crédit Agricole CIB, J.P. Morgan, Morgan Stanley and Société Générale. All the primary dealers were part of the syndicate.

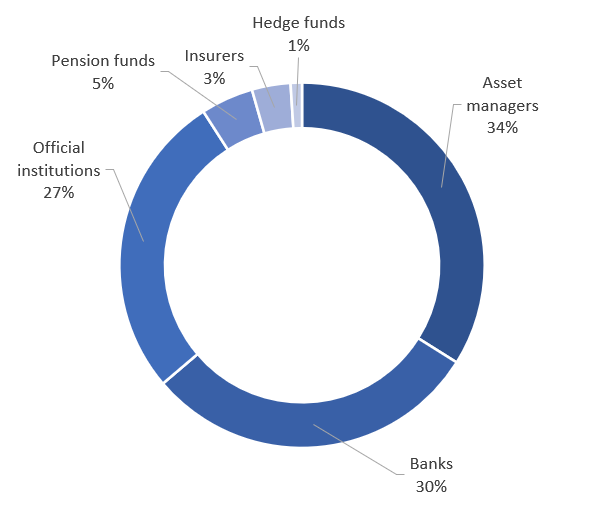

The allocation illustrates a large order book arising from a very diversified investor base, as more than 240 final investors took part in the transaction. The syndicated amount has been allocated to asset managers for 34%, banks for 30%, official institutions for 27%, pensions funds for 5%, insurers for 3% and hedge funds for 1% .

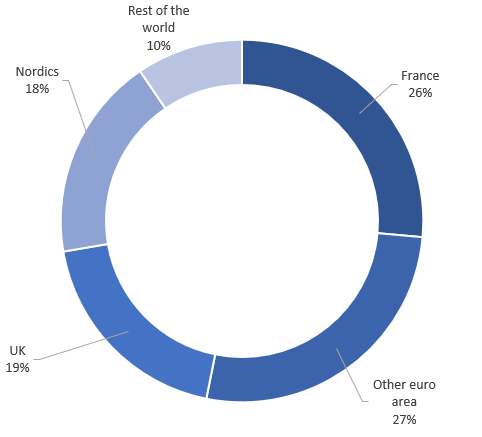

In terms of geographical distribution, France represents 26%, other euro area countries 27%, United Kingdom 19%, Nordics 18%, and rest of the world 10%.

Further details

The settlement date for the OAT is 1st April 2025. The bond will be strippable and quoted on Euronext Paris. It will be tapped to guarantee sufficient market liquidity, depending on market demand.

Contact:

+33 1 40 04 15 50